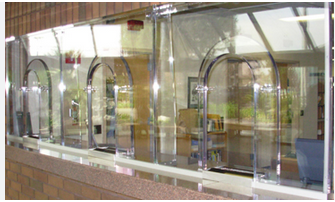

Teller Windows: The Heart of Customer Service

Business banking made a great progress way given that its inception, only one factor which includes remained unaffected will be the actual physical area where by buyers can go and carry out their cashiers tray transactions – the financial institution branch. In spite of the several computerized routes which have cropped up through the years, the physical wall socket remains the spine of financial. As well as the teller window, by using a teller seated behind it, is the most conspicuous facet of this set-up. Regardless of being an age-older method of doing deals, the teller home window continues to be the handiest way to carry out various banking routines.

The teller home window is the greatest technique for consumers to deposit funds, pull away money, spend bills, move cash, and more. This particular one-end-shop approach eliminates the demand for buyers to check out a number of different channels to handle their consumer banking activities. As an alternative to visiting an Atm machine for withdrawals, a piece of equipment for deposits, and a separate graphical user interface for bill repayments and exchanges, customers can full every one of these jobs quickly and efficiently in a few minutes in a teller home window. The teller window houses every one of the instruments and assets essential for coping with these dealings, thus protecting consumers beneficial money and time.

Another advantage of teller house windows is capability to offer immediate help. When customers use a question or issue that must be solved, they may quickly walk as much as a teller window and speak with a educated financial institution staff. The teller can rapidly solve the matter or provide assistance to customers who want it, without resorting to these people to make a scheduled visit or wait around for a callback.

Teller house windows in addition provide consumers having an included level of security. Since deals are handled with a teller, buyers could have assurance that their funds along with other personal information are safe. There is absolutely no chance of problems like misplacing a cheque or depositing it into the incorrect bank account, as tellers are highly skilled and experienced with their jobs.

In addition to being successful, teller microsoft windows can also help consumers make a relationship making use of their local department. Given that clients can develop connection with tellers with time, they are able to also produce trust and commitment with their lender. This personalized contact is very important and can produce a important variation in customer care amounts.

To put it briefly:

In In a nutshell, the teller window continues to be quite definitely related to modern-day banking and remains the most beneficial way for consumers to execute their deals. When electronic routes have introduced new methods of business banking, the teller home window continues to be backbone from the consumer banking market and takes on a necessary role in offering clients with an efficient, risk-free, and personal consumer banking encounter.